| Uploader: | Siumo |

| Date Added: | 16.06.2017 |

| File Size: | 80.72 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 23388 |

| Price: | Free* [*Free Regsitration Required] |

IRS Form W-2 Download Printable PDF or Fill Online Wage and Tax Statement - | Templateroller

This will ensure the IRS can correct the W-2 form with the proper information. Depending on how you filed your taxes, you may need to mail this form or file it online. When you file forms W-2c and W-3c, you should also refer to the penalties section of the current General Instructions for Forms W-2 and W-3 for more information. fillable w2 form free download - Free File Fillable Forms, W2 Mate , W2 Pro Professional Edition, and many more programs Fill in the IRS Form W-2 in PDF format. Free Publisher: IRS. Download Printable Irs Form W-2 In Pdf - The Latest Version Applicable For Fill Out The Wage And Tax Statement Online And Print It Out For Free. Irs Form W-2 Is Often Used In Irs W-2 Forms, U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms/5().

Fillable w-2 form 2018 download free pdf

A form limitation may keep you from completing or e-filing your return. Review the list of available supported forms you plan to complete and click on the Known Limitations link to determine if the limitation will affect your ability to use the program.

We will post an available date when known. ET on the date shown. Known Limitations Line-by-Line instructions are available. Additional Income and Adjustments Line-by-Line instructions are available. Additional Taxes Line-by-Line instructions are available. Household Employment Taxes Line-by-Line instructions are available. You can complete the form and mail it with your return. Employee Business Expenses Line-by-Line instructions are available.

Child and Dependent Care Expenses - Known Limitations Complete line 1 columns a through d for each person or organization that provided the care. Line-by-Line instructions are available. Foreign Earned Income Line-by-Line instructions are available. Moving Expenses Line-by-Line instructions are available.

Residential Energy Credits Line-by-Line instructions are available. It must be mailed in. Qualified Adoption Expense Line-by-Line instructions are available.

Additional Medicare Tax Line-by-Line instructions are available. Fillable w-2 form 2018 download free pdf program does not support "Kidnapped" as additional information you can enter on the schedule. You will have to print and mail in the return. Line 2 columns b through f will not allow you to enter "From Schedule K-1 Form S " across these columns.

Column g is a calculated filed and will not allow manual entry. Form C is not supported; therefore, the taxpayer must mail in the return with the Form C attached. The program restricts the user to attaching no more than four 4 Forms. You may only add one of these forms to your return. Each taxpayer and spouse on the return is able to add one Form to the return. You cannot add more than one Form for either the Taxpayer or Spouse. Forms C and D are not supported in the program.

If you need these forms to complete Formyou must mail in the return. For each child that meets the Special Circumstances described in the instructions, you must only select the "No" box, for the applicable lines A — D, in Part 1. Do not select both boxes, per the instructions for the schedule.

Presently, Schedule will not accept more than four 4 qualifying children and you are not able to add more than one 1 Schedule to a return. If you have more than four 4 qualifying children to add to Scheduleyou will not be able to e-file the return. You can only attach Form by first opening the associated Schedule C.

You may only associate one Form to a Schedule C. If you need to associate more than one Form to a Schedule C, create another Schedule C's for the same business — associate one form to one Schedule C and the other form to the second Schedule C properly allocating all other income and expense items.

Line 8 AGI from your main form is automatically calculated. If you are filing Formyou are not able to add to that amount any exclusion or deduction claimed for the year for: Foreign earned income, Foreign housing costs, Income for bona fide residents of American Samoa, and Income from Puerto Rico - back to list. You cannot efile you return with this form attached. To file this form and receive a credit, this form requires you to attach documents associated with line 2.

The Free File Fillable Forms program does not support attaching documents. If you need to include Form with your return, you must mail in your return. If the Death of Account Beneficiary provision applies to you and you are not required to complete Part I, you will not be able to e-file your return with form You may complete your return, using Form and mail in your return.

Line 13 calculates the smaller of fillable w-2 form 2018 download free pdf 2 or If you are instructed to add any amount to what is calculated for line 13, you will not be able to do so and still efile the return. You can manually complete Form and mail in your return. This form will only support one qualifying vehicle. If you are trying to claim more than one qualifying vehicle, you will not be able to use this form and e-file your return.

Taxpayers may only attach one of these forms to their return, fillable w-2 form 2018 download free pdf. The form has two pages, fillable w-2 form 2018 download free pdf. Parts V and VI are on page 2. You may add, as continuation pages, a total 25 copies of page 2 continuation pages. Line 26 is automatically calculated. If you are electing to use the alternative calculation for marriage, you cannot manually enter a zero on line The program will not allow more than four codes in box 12 or box The program will not allow the user to add more than thirty 30 W-2s.

The program will not allow the user to add more than thirty 30 W-2Gs. More In File. If you need to attach any such documents, you will have to print and mail in the return.

Writing in Additional Information - Lines on some forms may request that you "write in" additional supporting information. Your ability to do this is limited to FormSchedules 1, 2, and 3; plus, a few of the most frequently used forms and schedules. When allowed, fillable w-2 form 2018 download free pdf, the form provides designated spaces for this information.

You can enter a maximum of one description and amount combination per line, where writing in additional information is permitted. If the form does not provide a space for this information, you may not be able to use this program to efile your tax return, fillable w-2 form 2018 download free pdf. Decedent Returns - The program might not efile a decedent return, fillable w-2 form 2018 download free pdf.

E-filing Forms - To efile forms, except Form they must be attached to Form Specific Form Limitations A form limitation may keep you from completing or e-filing your return. If you have another type ofread STEP 2 Section 1 and Section 2B about entering federal withholding from another type of document. If you do not have any property to list fillable w-2 form 2018 download free pdf page 1 of Schedule E, you will not be able to file Form with Schedule E.

An AMT version of this form is not available. All copies if Form will transfer line 30 to Form line This will not cause your return to reject. We suggest you print the individual form for your records.

The program does not support an AMT version of Form Line 30 of every Form you add to your return will total to Formline If a single student attended more than two 2 different universities during the year, they will not be able to efile when completing more than one more than one page two Part III.

If you are filing Formyou are not able to add to that amount any exclusion or deduction claimed for the year for: Foreign earned income, Foreign housing costs, Income for bona fide residents of American Samoa, and Income from Puerto Rico - back to list FormHealth Coverage Tax Credit: You cannot efile you return with this form attached. Direct Pay. About the Fillable w-2 form 2018 download free pdf File Program.

Page Last Reviewed or Updated: Feb Interest and Ordinary Dividends Line-by-Line instructions are available. Capital Gains and Losses Line-by-Line instructions are available.

Annualized Income Line-by-Line instructions are available.

Fillable w-2 form 2018 download free pdf

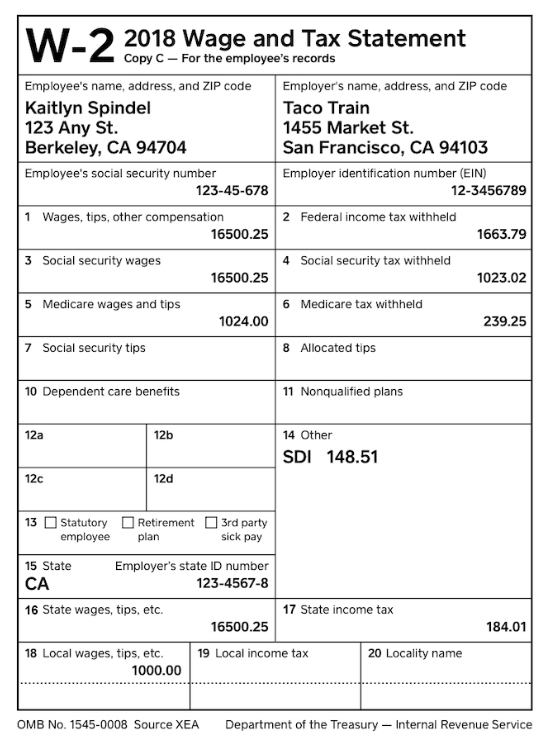

What Is A W-2 Form? Form W-2 is intended for Wage and Tax Statement. An employer has to fill out the W-2 and further send to employees and the US Department of Revenue. In this form an employer provides detailed information about the amount he paid to employees and deducted taxes. What is a W 2 Form The W-2 Form is a tax form for the Internal Revenue Service (IRS) of the United States. It is used to report wages paid to employees and taxes withheld from blogger.com the formal expression of the W 2 form is the "Wage and Tax Statement".As part of the employment relationship, the employer must fill out the W 2 form for each. The IRS W-2 Forms are a series of six documents issued by the Internal Revenue Service (IRS). The main aim of these forms is to furnish the information about earnings to the employees, IRS, and the Social Security Administration (SSA) and to correct the already furnished information.

No comments:

Post a Comment