| Uploader: | Tormodg |

| Date Added: | 04.04.2018 |

| File Size: | 41.88 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 28799 |

| Price: | Free* [*Free Regsitration Required] |

Assessor & Property Values | Story County, IA - Official Website

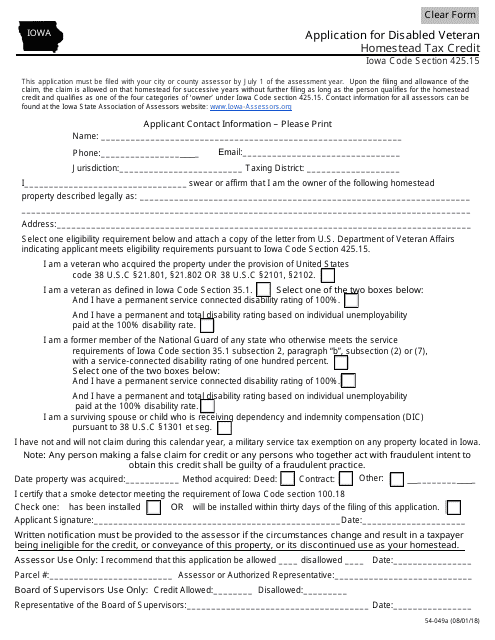

Eligibility: Must meet the requirements contained in Iowa Code section (38) and the administrative rules in IAC section Filing Requirements: Person claiming the exemption shall file an application with the assessor by February 1 of the first assessment year the exemption is requested. Utilize the Iowa Department of Revenue's ePay tool to take the stress out of paying your taxes. Learn more here. State of Iowa eFile & Pay | Iowa Department of Revenue. Assessor Duties. The assessor is charged with several administrative and statutory duties; however, the primary duty and responsibility is to cause to be assessed all real property within his/her jurisdiction except that which is otherwise provided by law.

Iowa assessor file downloads

A reappraisal was completed for the following classes of property: commercial, industrial and multi-residential. The assessment notices have been mailed for those classes. The residential and agricultural class assessment rolls will be mailed before April 1st if there has been a change of value for The Iowa State Association of Assessors hosts a website with assessment information, board of review information and several links to pertinent websites.

Credit and exemption applications are availabe on the Iowa Department of Revenue websit. Click on the following link. Prior year values for commercial property are shown twice for The use of CSR2 and non-crop adjustments for agricultural land was implemented in the valuations.

Senate File established a business property tax credit for commercial, industrial and railway property. Each person who wishes to iowa assessor file downloads the credit shall obtain the appropriate forms from the County Assessor. Parcels classified and taxed as commercial property, industrial property or railway property, under chapterare eligible for a credit.

A person may claim and receive one credit under this chapter for each eligible parcel unless iowa assessor file downloads parcel is part of a property unit, iowa assessor file downloads.

You don't need to sign up annually. Once owership of part of the parcel or property unit is transferred, it becomes necessary to re-sign. Assessor Hub provided by Vanguard Appraisals, Inc.

Clark County Assessor's Office

, time: 8:11Iowa assessor file downloads

Brenda Loftus, Assessor Home Real Estate Search Sale Search Building Search Assessor's Duties Owner's Legal Responsibility Credit and Exemptions Assessment Appeal . The Hancock County Assessor may provide property information to the public "as is" without warranty of any kind, expressed or implied. Assessed values are subject to change by the assessor, Board of Review or State Equalization processes. Additionally, statutory exemptions may affect the taxable values. Assessor Duties. The assessor is charged with several administrative and statutory duties; however, the primary duty and responsibility is to cause to be assessed all real property within his/her jurisdiction except that which is otherwise provided by law.

No comments:

Post a Comment